Oxford China Academics

Oxford In China > Oxford China Academics > Zhou Yunxu

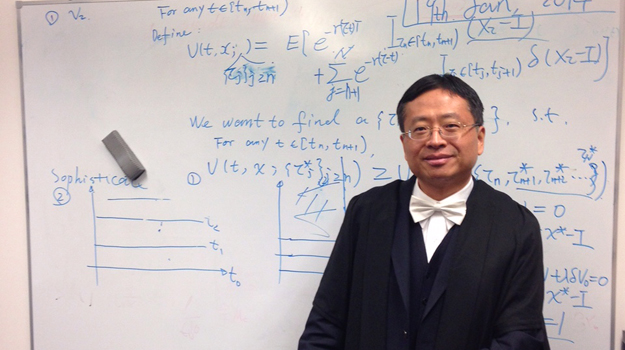

Professor Zhou Xunyu is a Statutory Chair of Mathematical Finance at the University of Oxford. He is the Director of the Oxford-Nie Financial Big Data Lab, and Professorial Fellow of St Hugh’s College. Born in Jiangsu Province, he obtained his PhD in Applied Mathematics at Fudan University in 1989. His academic career has taken him across China, Japan (Keio University and Kobe University), Canada (University of Toronto), and Hong Kong (The Chinese University of Hong Kong). In 2007, he joined Oxford as a chair in Mathematical Finance. Professor Zhou is an internationally leading expert in quantitative finance, stochastic control and applied probability, while he currently focuses on mathematical behavioural finance research. He is an IEEE Fellow, a Humboldt Distinguished Lecturer, an invited speaker at the International Congress of Mathematicians, and the recipient of the Royal Society Wolfson Award, SIAM Outstanding Paper Prize and Croucher Senior Research Fellowship. He has been on the editorial boards of many leading international journals.

Describe a day in your life at Oxford.

I get up at 7 and have breakfast while browsing the news on my iPad, I get into the office at 8.30 and if I am not teaching, my morning is usually taken up with administration, such as answering emails, editorial jobs, research group activities). After lunch at my college, St Hugh's, the afternoon is dedicated to research - writing papers, conducting reading group meetings with DPhils and discussions with students. In the evenings I read all kinds of books, except anything mathematical!

I get up at 7 and have breakfast while browsing the news on my iPad, I get into the office at 8.30 and if I am not teaching, my morning is usually taken up with administration, such as answering emails, editorial jobs, research group activities). After lunch at my college, St Hugh's, the afternoon is dedicated to research - writing papers, conducting reading group meetings with DPhils and discussions with students. In the evenings I read all kinds of books, except anything mathematical!

Maths was my origin and destination... it is interesting to find that the mathematics guiding a missile and managing a mutual fund is the same.

Tell us about your background and how you became interested in mathematical finance?

I have a quite unique, multidisciplinary background. My undergraduate degree was in pure maths and PhD in applied maths. I worked in a business school as a postdoc prior to my 14-year career in an engineering school. Then I returned to maths in Oxford. It was a spiral path with maths being both the origin and destination. My original specific research area was stochastic control. In late 1990s I was developing what I called ``indefinite linear-quadratic control” theory, and found around 1998 that the theory could be readily applied to a continuous-time mean—variance portfolio selection problem. It’s interesting to find that the mathematics behind guiding a missile and managing a mutual fund is the same. I became so attracted by mathematical finance and gradually switched to the area while learning finance and economics theory by myself.

I have a quite unique, multidisciplinary background. My undergraduate degree was in pure maths and PhD in applied maths. I worked in a business school as a postdoc prior to my 14-year career in an engineering school. Then I returned to maths in Oxford. It was a spiral path with maths being both the origin and destination. My original specific research area was stochastic control. In late 1990s I was developing what I called ``indefinite linear-quadratic control” theory, and found around 1998 that the theory could be readily applied to a continuous-time mean—variance portfolio selection problem. It’s interesting to find that the mathematics behind guiding a missile and managing a mutual fund is the same. I became so attracted by mathematical finance and gradually switched to the area while learning finance and economics theory by myself.

What do you find most exciting about your current work?

I have been working on quantitative behavioural finance in the past 10 years. On one hand, it is a multidisciplinary area involving economics, finance and psychology, that attempts to explain and predict financial market patterns arising from irrational and flawed human behaviours. On the other hand, it begs for new and innovative mathematical approaches to solving the behavioural models or even gives rise to new mathematical theories. I found these most exciting.

Oxford is one of the world powerhouses in data science research.

Big data has a potentially revolutionary role to play in our understanding of the behavior of financial markets. As Director of the recently launched Oxford-Nie Financial Big Data Lab, supported by Mr Nie Fanqi and his company FDT, what do you see as the significance of the University’s commitment to being a leader in the use and development of data science research?

Oxford is one of the world powerhouses in data science research, evidenced by the launch of the Big Data Institute (under the Li Ka Shing Centre for Health Information and Discovery) and the key involvement in the Alan Turing Institute. The opening of the Oxford-Nie Financial Big Data Lab marked a new dimension of big data research in the area of finance, the first of its kind at a major university in the world. This further strengthens the overall big data research portfolio across Oxford, and demonstrates the university’s commitment to being a global leader in this increasingly important area.

Oxford is one of the world powerhouses in data science research, evidenced by the launch of the Big Data Institute (under the Li Ka Shing Centre for Health Information and Discovery) and the key involvement in the Alan Turing Institute. The opening of the Oxford-Nie Financial Big Data Lab marked a new dimension of big data research in the area of finance, the first of its kind at a major university in the world. This further strengthens the overall big data research portfolio across Oxford, and demonstrates the university’s commitment to being a global leader in this increasingly important area.

One of your research focus is on the way psychology and emotion affect decision-making and risk analysis. You have also said that mathematical theory can bridge the gulf between finance and social science. How does being at Oxford, with its breadth of expertise across disciplines, help you in this approach?

One of the biggest enjoyments of being at Oxford is it has world leaders in almost every field, be it in sciences, engineering or social sciences. Or even in law, for that matter. This benefits particularly multi-disciplinary research areas such as quantitative behavioural finance. The Oxford-Man Institute for Quantitative Finance provides an organised platform for interdisciplinary interactions and collaborations, through seminars, workshops, or even daily lunches. For my own research group, I have also been organising an ``internal seminar series” where leading experts from different departments across Oxford have been invited to give talks.

Does your work involve collaboration with organisations and institutions in China?

I have scientific collaboration with scholars from Chinese Academy of Sciences, Nanjing University, and East China Normal University.

I have scientific collaboration with scholars from Chinese Academy of Sciences, Nanjing University, and East China Normal University.

Don’t do parallel extensions; do something new.

What is the biggest challenge you are facing right now?

DPhil scholarship. In Oxford, DPhil admission and financial support are separated. Often we have identified an excellent candidate, only to see him/her going to another university because we don’t have funding support. This is one of the biggest challenges. In many other parts of the world, such as the US or Hong Kong, financial support comes as part of the PhD admission package. If this is to continue, Oxford will lose the best DPhil students to its competitors and therefore jeopardizes the long term sustainability of its research leadership.

What is the best piece of advice you’ve ever received?

It was from my PhD supervisor, Professor Xunjing Li: ``Don’t do parallel extensions; do something new.”

DPhil scholarship. In Oxford, DPhil admission and financial support are separated. Often we have identified an excellent candidate, only to see him/her going to another university because we don’t have funding support. This is one of the biggest challenges. In many other parts of the world, such as the US or Hong Kong, financial support comes as part of the PhD admission package. If this is to continue, Oxford will lose the best DPhil students to its competitors and therefore jeopardizes the long term sustainability of its research leadership.

What is the best piece of advice you’ve ever received?

It was from my PhD supervisor, Professor Xunjing Li: ``Don’t do parallel extensions; do something new.”

Interviewed in September 2015